Understanding Budgeting: A Comprehensive Guide

In today’s dynamic financial landscape, mastering the art of budgeting is a critical skill for individuals and businesses alike. Efficient budgeting empowers us to navigate the complexities of personal and organizational finance, ensuring financial stability and strategic growth. In this comprehensive guide, we delve into the depths of budgeting, unraveling its significance, methods, and practical applications.

Defining Budgeting

Budgeting is the systematic allocation of financial resources to achieve specific goals within a defined timeframe. It serves as a roadmap for financial decision-making, offering a structured approach to income and expenditure management.

Key Components of Budgeting

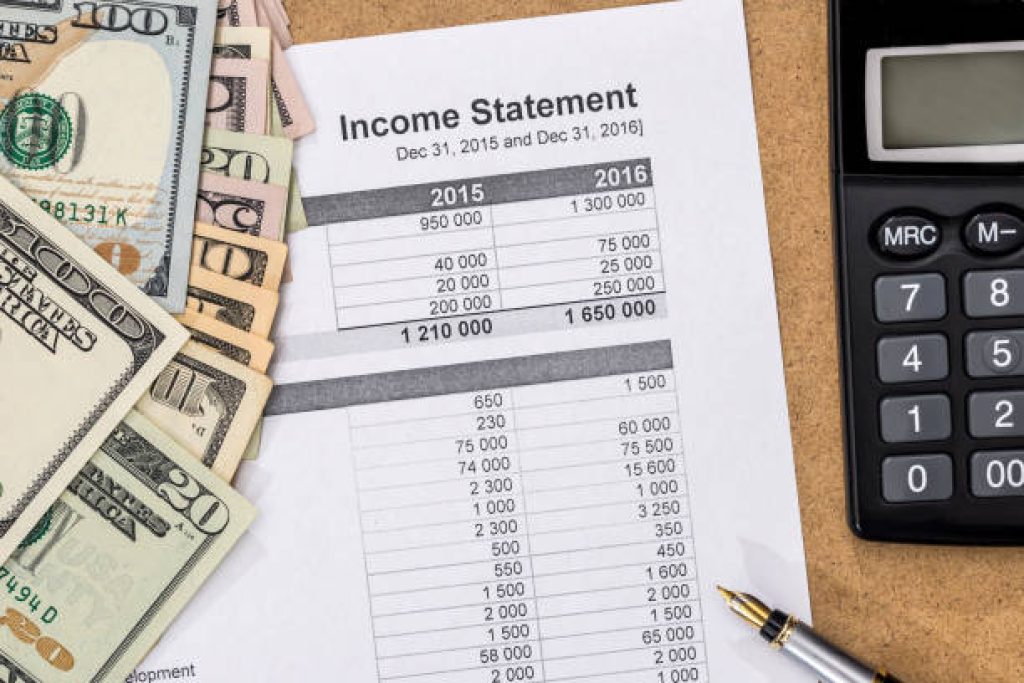

1. Income Analysis

Understanding your income sources is fundamental to effective budgeting. Categorize and quantify all revenue streams, providing a clear overview of your financial inflows.

2. Expense Categorization

Classify expenses meticulously to identify discretionary and non-discretionary spending. This categorization lays the foundation for strategic cost-cutting and resource optimization.

3. Setting Financial Goals

Define short-term and long-term financial objectives. Whether it’s saving for a vacation, an emergency fund, or retirement planning, clear goals guide the budgeting process.

Budgeting Methods

1. Zero-Based Budgeting

Assign every dollar a specific purpose, leaving no room for ambiguity. This method instills discipline and ensures a meticulous allocation of resources.

2. Incremental Budgeting

Build on the previous budget, making incremental adjustments based on past performance and future expectations. This method allows for flexibility while maintaining a historical perspective.

3. Activity-Based Budgeting

Align expenditures with specific activities or projects. This method is particularly effective for businesses, providing a detailed insight into the cost structure of each operation.

The Role of Budgeting in Financial Success

Effective budgeting contributes to financial success by providing:

- Financial Discipline: Budgets instill discipline, curbing unnecessary spending and promoting fiscal responsibility.

- Risk Mitigation: Anticipate and mitigate financial risks by identifying potential issues through regular budget reviews.

- Resource Optimization: Maximize the impact of every dollar spent, ensuring efficient resource utilization.

Implementing this comprehensive guide to budgeting equips you with the tools to take control of your financial destiny. As you embark on this journey, remember that successful budgeting is an ongoing process of analysis, adaptation, and disciplined execution. May your financial endeavors be guided by strategic foresight and the power of a well-crafted budget.