Evaluating Incidental Costs: A Comprehensive Guide

In today’s financial landscape, meticulous budgeting is crucial for successful financial management. One often overlooked aspect that can significantly impact your financial plan is incidental costs. In this article, we delve into the intricacies of incidental costs, providing insights to ensure that your budget remains resilient and comprehensive.

Understanding Incidental Costs

Defining Incidental Costs

Incidental costs refer to unexpected or unplanned expenses that may arise during the execution of a project, purchase, or any financial endeavor. These costs are not part of the primary budget but can exert a substantial influence on the overall financial outcome.

Examples of Incidental Costs

- Maintenance and Repairs: Equipment breakdowns or unexpected repairs can lead to unforeseen expenses.

- Regulatory Compliance: Changes in regulations may necessitate adjustments to your operations, incurring additional costs.

- Market Fluctuations: Economic shifts can impact prices, affecting your budget for goods and services.

Strategies for Managing Incidental Costs

Conducting Risk Assessments

Before embarking on any financial venture, it is imperative to conduct a thorough risk assessment. Identifying potential sources of incidental costs allows for proactive planning and mitigation strategies.

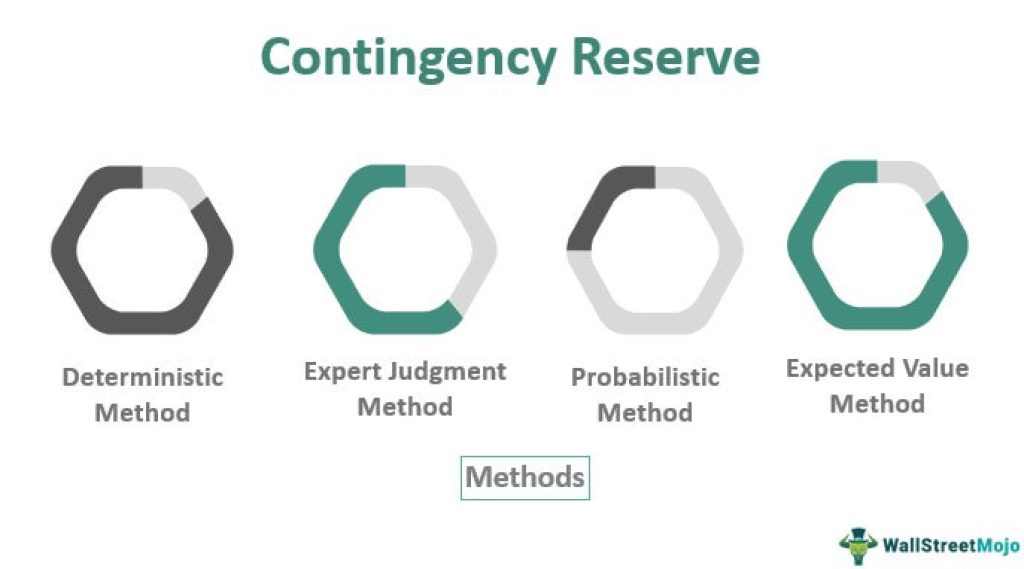

Building Contingency Reserves

Allocating a portion of your budget as a contingency reserve acts as a financial safety net. This reserve can be tapped into when unforeseen costs emerge, preventing financial strain.

Continuous Monitoring and Adaptation

Regularly reviewing and adjusting your budget based on emerging trends and circumstances ensures that you stay ahead of potential incidental costs. Flexibility is key in maintaining financial stability.

The Impact on Different Sectors

Business Operations

Incidental costs can significantly affect businesses, impacting profit margins and operational efficiency. Implementing robust risk management strategies is essential for sustained success.

Construction Projects

In the construction industry, unexpected delays or material price fluctuations can lead to cost overruns. Thorough planning and constant monitoring are critical to preventing budget deviations.

Personal Finances

Individuals must also be vigilant about incidental costs in daily life. From home maintenance to unexpected healthcare expenses, being financially prepared is a proactive approach to mitigating risks.

Conclusion

In conclusion, acknowledging and preparing for incidental costs is integral to financial prudence. Whether you are managing a business, overseeing a construction project, or simply navigating personal finances, understanding the potential impact of unplanned expenses empowers you to make informed decisions.

This comprehensive guide equips you with the knowledge and strategies needed to navigate incidental costs successfully. Stay proactive, build resilience into your financial plans, and ensure that your budget stands strong against unforeseen challenges.